Oxford County:

Active & New Listings continue to decline since the peak

in May at 328 new listings coming to market. In July only 239 homes were listed.

In august this number dropped to 198 new listing across the entire County. When

added to the few remaining previously listed homes supplies remain limited. The

number of homes offered for sale dropped further under the current 2 months, supply

level. Remember a balanced market, where bidding wars don’t take place, is 6

months’ supply!

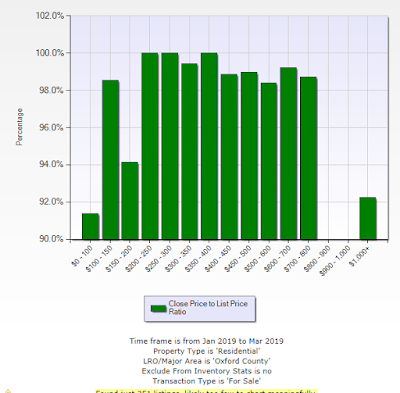

The bidding wars are continuing. In February Homeowners the

highest level of bidding wars occurred with the listing price to selling price

ratio averaging over 11% above asking prices. Since then, the level of bidding

wars prices has been steadily dropping. Usually, June is the top selling month

of the year. The average price for June was 4.9% above asking prices. The

average selling price to listing price in July, fell to 4.1% above asking prices.

It has started to climb again due to further reduction of inventory in August

to the lowest level since March. This will cause prices to climb again as we

enter the Fall selling period. Remember in January we started the year with 92 homes

sold across the County. We peaked in May with sales of 267 homes selling. June

was quieter, as detailed above, with sales of only 222 home, falling again in

July to 201 homes sold and finishing the Summer months with only 195 sales in August.

Inventories of available properties remain unusually tight, however,

even with constant bidding wars occurring the average selling prices have been

sitting around the $635,000 mark. The

average selling price peaked in June, across the County, at $649,211, falling during

July to $609,131. The prices have started to rebound in august to $633,055. The

average number of days it takes to sell a home has risen from a low in April

and May of 10 days, to 12 days in June, 15 days in July and 16 days for the

month of August.

The reason the Listing Price to Selling Price ratio is

declining is the result of some Homeowners trying to push the market by listing

at a top selling price for a specific size and feature of a home and are

therefore not receiving bidding wars and usually end up selling 2% to 3% below

listing price. Homes priced below market,

say at $599,900, about $50K to $75K below value are getting massive bids and

often do better than a market priced home. Buyers from out of town, with an

out-of-town Realtor, are looking at Realtor.ca and can only see competing homes

for sale. Out of Town Realtors cannot see what homes are actually selling for.

Summary:

The London Area which includes Oxford County in terms of

Pricing is offering the 4th lowest priced market of the 12 major markets monitored

across Canada.

Always remember, I am here to help in any way that I can be

of service to you and your family.

First, I have a message for First Time Home Buyers. In this crazy on-going

Covid Market, you may need Family support for the down payment to help you bid what

appears to be 10% to 15% over the asking price or look for a real fixer upper

with good potential. The first step is

to get pre-qualified by a Mortgage Broker or your Bank. Once you find out what

you can reasonably afford, plan to bid above the asking price as described

above with a Cash, Non-Conditional Offer with a short closing if you are

renting. With the average price still

rising, you will logically be able to pay back Mom and Dad within 24 months. Sweat equity in a fixer upper can yield big

dividends. As your Realtor, I will investigate market values in your planned

neighbourhood and provide comparable sales.

Now for you Move-Up Buyers, now is the best time to use some

of that equity that you have built up over the last year. The first step is to

get pre-qualified by your existing mortgage holder and outline how your new

mortgage will be blended without penalty. Once you find out what you can

reasonably afford, I will evaluate the Market Value of your home and outline

all contingencies at no cost to you. This will give you the ability to safely

overbid the asking price with a Cash Non-Conditional Offer and a closing of 2

to 3 months. If priced reasonably, you can expect the same over-bidding that

you are making. Your equity will cover the excess price on Closing. With the average home selling within 2 weeks,

the risk is virtually non-existent.

Lastly, if you do not have to sell, this is the worst time to

do so! Every day that passes brings increased equity to our current homeowners.

I am here ready to assist!

Do not wait, pick up the phone, or email and I will be at

your side, looking after the best interests of You and Your Family!

Just Call:

Cell- 519-535-3975

Home Office- 548-688-8833

Email- gib@youtfavouriterealtors.com

MLS connected Website – http://OxfordProperties.ca